I see articles around (like here on Medium.com) comparing TESLA stock with bitcoin bubble.

As a reminder, the bitcoin bubble is one of the craziest and idiotic speculation manias we did see lately; people were paying 18.000$ for a digital code on an exchange platform (no delivery, nothing. Just a a number on a digital online account; go figure!). All this in the hope that it will find a dumber person to whom sell later for even more dollars. And it did work for a few years if you can believe that; in 2017 the price for a single unit of the digital currency BTC went as high as 18.000$. Ok, you know that already...

There are a lot of believers in bitcoin; there were even more at the end of 2017.

As you can see, the parabola started to go vertical at the begining of 2017; it was trading sub 2000$ a unit. By the end of the year, it went up 9x to 18.000$.

I had an office colleague who explained to me how the currency cannot go down because of enthropy (I cant remember what the explanation was; something stupid for sure as I remember nothing of it and I did not understand what it means; probably nothing). He was a true believer in 2017. After the implosion, he lost some money and sweared he will never play BTC anymore. I dont know what he thinks today... maybe he's buying TESLA stock...

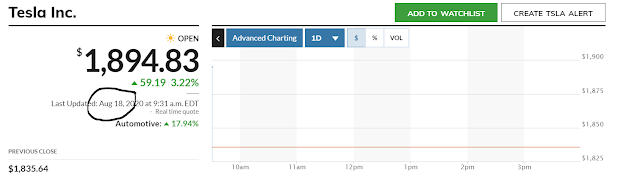

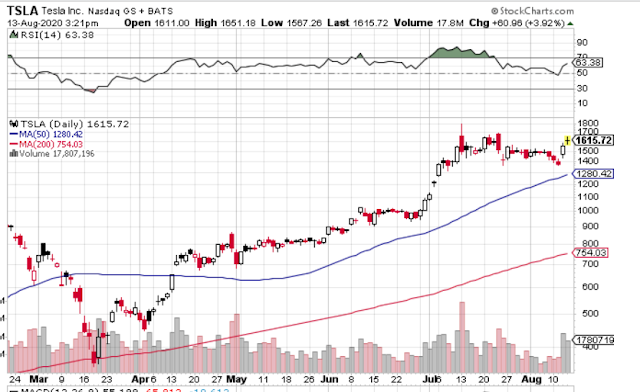

The same goes with TESLA; as you see the public acclaiming Elong the God every time he goes on stage talking about his next big project, you cant think of these as true believers. There is nothing wrong believing in some exciting project, the problem everybody is so euphoric they cant think clearly anymore. A bit of scepticism from time to time doesnt hurt anyone; its probably even healthy. And the TESLA stock? Lets have a look

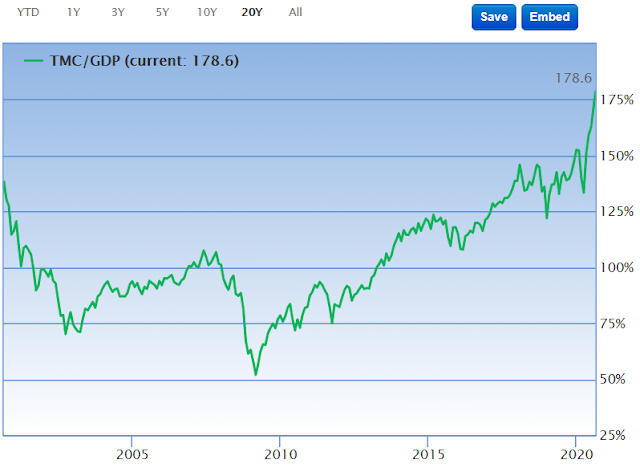

Things started to move vertical on TESLA stock end of 2019 when it was trading around 200$; it suffered a correction because of the COVID pandemic at around 400$. But then it moved back higher to 1800$ in less than 4 months. That's a 9x increase since the end of 2019, similar to bitcoin prices. Amazing!

So there you have it, the same order for the price increase but TESLA stock moved even faster than bitcoin!

So to answer Medium's article question: Is TESLA the new bitcoin?

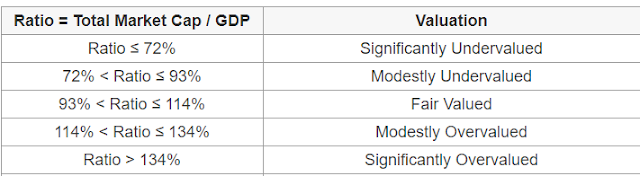

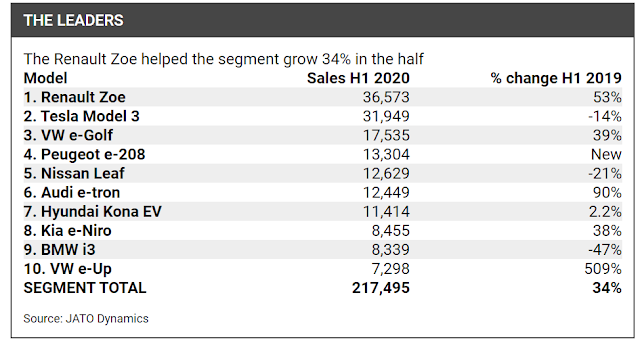

If we refer to TESLA the company, the answer is of course not. Bitcoin as a currency serves no purpose (the technology behind it might be interesting) while TESLA produces cars which are useful for mobility. However, if we talk about the TESLA stock, than the answer is Yes, TESLA is the new bitcoin. Which means that a crash similar to bitcoin is not impossible.

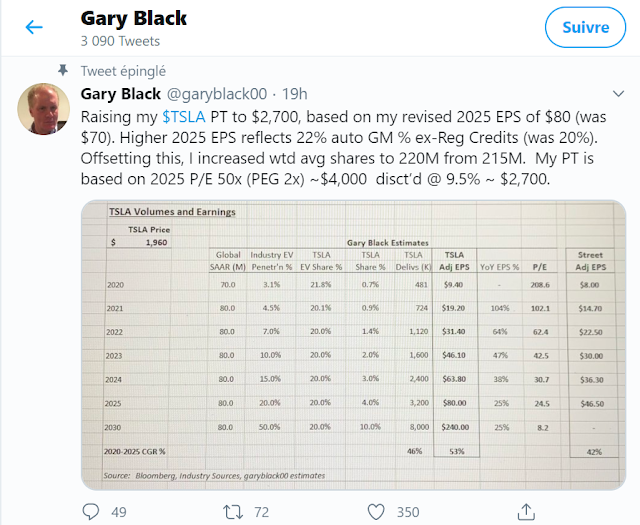

And one last thing; similar to bitcoin in 2017 when I was reading that price of the currency will go up to 100.000$ per unit (and I remeber some were even sillier than that; towards a million $ or so...), we can hear 5000$ and 7000$ per stock for TESLA. Ok we dont hear yet 100.000$ but here you have it:

TESLA stock will go up to 100.000$! Do you believe me?

Medium article concludes the same thing

some models predicting Tesla’s share price for the next 5 years see it reaching $7,000 and possibly $15,000 at best in 2024.

If such predictions were to come true, Tesla’s performance would be between +1,000% and +2,000% in 5 years. We are still a long way off but this is a strong incentive to consider Tesla as an investment for the years to come.

Finally, in any case, remain cautious because as I have explained, we are not immune to the fact that all this is just a bubble around the price of Tesla that will explode in the coming months.

As silly as that sound, it is not impossible.