Tesla has never declared dividends on our common stock. We intend on retaining all future earnings to finance future growth and therefore, do not anticipate paying any cash dividends in the foreseeable future.

mercredi 29 juillet 2020

Is TESLA paying any dividends?

vendredi 24 juillet 2020

NKLA stock accelerates towards ZERO

jeudi 23 juillet 2020

Elon wants TESLA not go bankrupt (or slightly profitable). Whatever...

We need to, you know, not go bankrupt, obviously, that’s important....But we’re not trying to be super profitable, either, Musk said toward the end of Wednesday’s conference call.

I think just we want to be like slightly profitable and maximize growth and make the cars as affordable as possible, he concluded.

mercredi 22 juillet 2020

TESLA earnings report

Elon Musk has done it again, beating Wall Street’s expectations for Tesla’s earnings significantly for the fourth quarter in a row.

In our view, the $1,500+ stock price is not supported by fundamentals, with valuation driven largely by momentum and low rates." Among 10 reasons to remain cautious on Tesla, the analysts said that while volume growth is real, it is constrained by capacity expansion and capital availability; the EV market is likely smaller than appreciated; and Tesla's profitability and cash flow "are not great or consistent, and are major risks.

while Tesla is often compared to technology companies and industry disruptors like the FAANG stocks, Tesla's business model is capital intensive, which "makes its business much less scalable than that of a technology company.

mardi 21 juillet 2020

Bubbles by definition pop

Nearly all economists expect a huge jump in inflation associated with the Fed's massive balance sheet expansion and government fiscal stimulus.

Actually, inflation is easy to find. Look no further than the stock and bond markets.

The Fed's balance sheet expansion coupled with trillions of dollars of fiscal stimulus (both unprecedented) has resulted in stock market speculation also at unprecedented levels exceeding the housing bubble boom in 2008.

Long term bull case for TESLA?

- He likes found-run companies. Jeff Bezos, Mark Zuckerberg are driven by a lot more than money. No shit! I suppose Elon is the same...

- Tesla is like Amazon in its early days. When I told you this is not a car manufacturer but a technology behemoth you didn't believe me! Here you have it, a guy smarter than me is telling you so. TESLA is the next Amazon, a trillion dollar company (add by me: making no money).

- Tesla is producing cars at scale. 350.000 per year to be more precise versus 10 millions for Toyota. The analyst believes one day (he does not say what year but it could be by the next century) TESLA will produce as many cars as GM and Ford; in the meantime, waiting TESLA to produce those cars, his market valuation is 10x that of GM (you read that right: 10 TIMES!)

- Tesla is leading the way to a humanity with less carbon energy. I wont stop much here as this thesis imo is so weak; scratching the surface a bit shows that battery producing, recharging and recycling is not that carbon-free.

- TESLA stock catalysts: electric truck (good luck with that one), an electric roadster (roadster car markets is not growing that much overall - I know a thing or two about roadsters) - I think you can forget about this one btw, a model Y SUV - the competition will be tough on this segment as there are so may electric SUVs coming out, I did post a few on this blog as well. So this argument is very weak for the long term bull case.

- Wall Street is skeptical about TESLA. The idea is that more speculation is in the cards. I dont know how to read this one; judging by stock price action I tend to say people gambling with the stock are dumb investors; but it does not mean professional analysts will jump in with both feet; there are gamblers on WallStreet for sure, but serious investors are managing risk. I dont think TESLA stock is a good risk/reward investement. I might be wrong however.

lundi 20 juillet 2020

EV car maker Nikola stock cratering

dimanche 19 juillet 2020

Robinhood traders & TESLA speculation

Almost 40,000 Robinhood accounts added shares of the automaker during a single four-hour span on Monday, according to website Robintrack.net, which compiles data on the investing platform that’s much beloved by day trading millennials.

Amid challenging times and market volatility, we’re humbled that people are turning to Robinhood to participate in the markets and build their financial future. We added more than three million funded accounts so far this year, and we’re grateful for the opportunity to serve each customer.

Like so many others, Kearns took up stock investing during the pandemic, signing up with Millennial-focused brokerage firm Robinhood, which offers commission-free trading, a fun and easy-to-use mobile app and even awards new customers free shares of stock. During the first quarter of 2020, Robinhood added a record 3 million new accounts to its platform. As the Covid-19 stock market swung wildly, Kearns had begun experimenting, trading options. His final note, filled with anger toward Robinhood, says that he had “no clue” what he was doing.

In fact, a screenshot from Kearns’ mobile phone reveals that while his account had a negative $730,165 cash balance displayed in red, it may not have represented uncollateralized indebtedness at all, but rather his temporary balance until the stocks underlying his assigned options actually settled into his account.

samedi 18 juillet 2020

EV car makers competing TESLA

- Polestar. This is a new brand but it will share knowledge and parts with Volvo. Polestar and Volvo are owned by Geely, a chinese car company who bought Volvo during the financial crisis of 2009 when the Sweedish car manufacturer was in bad shape. Volvo is a serious car manufacturer and Polestar, imo can become a serious name in the EV space.

- Faraday Future. This is a troubled brand with many annoucements (2016 CES in Las Vegas) and very little follow up. They position in the high-end SUV EV space. This thing might dissapear rather soon (I dont think they own some technologic advance, I might be wrong however).

- Nio Motors. This is a startup trying to survive. My understand is they position for mass EV production, for now they did not manage to deliver. They did start selling 2 SUV models in China. Since 2014, analysts estimate this company lost more than 6$ billions. Unprofitable companies are very loved by speculators these days. Like for TESLA, the stock price wen parabolic since March 2020 on stupid speculation (700% increase). My take is this company wont survive. Lately, the stock did start cratering and will probably accelerate towards ZERO!

- Xpeng. It is a chinese startup offering a crossover with lots of connectivity in it. Based on China Passenger Association data, the G3 Xpeng model is the best-selling China EV model from a new company (whatever that means). Check out the G3 2020 model.

- MG. This is an old british car manufacturer which was bought by chinese investors. The company did put on the market a very interesting EV SUV, the MG ZS: european standards at a very competitive price, below 25.000$. It is probably the best quality/price EV car you can buy today. This model will maks some waves. Watch this video for a review of MG ZS

jeudi 16 juillet 2020

TESLA will report next Wednesday

Earnings: Consensus from 33 Wall Street analysts polled by FactSet calls for a GAAP loss of $1.10 cents a share, which would compare with a GAAP loss of $2.31 a share in the first quarter of 2019. The analysts expect an adjusted loss of 36 cents a share, which would compare with an adjusted loss of $1.12 a share a year ago.

Estimize, a crowdsourcing platform that gathers estimates from Wall Street analysts, as well as buy-side analysts, fund managers, company executives, academics and others, is expecting an adjusted profit of 6 cents a share.

Revenue: The analysts surveyed by FactSet expect sales of $5.0 billion for Tesla, down from $6.4 billion a year ago. Estimize sees revenue of $5.3 billion for the company.

Earnings do not matter; TESLA stock will go up!

TESLA - the short term risks

- TESLA stock looks pricey

- No bubble, just pricey 😁. That's risk numero uno!

- If you go over the article, the guy compares it with GM and Ford; dont know why... as I said, this is a category killer (i.e. it kills categories) and not a car manufacturer (whatever this is, we dont care for now...)

- He mentions that last Monday alone - 3 days ago - 40.000 Robinhood traders (aka milenial speculators) did buy TESLA shares. No shit!

- TESLA may raise money

- Well that happened before and did not stop TESLA stock to go parabolic. For me this is not a problem.

- They can raise 100$ trillions, stock will go up!

- The electric vehicle industry seems bubbly

- Again, nothing to do with TESLA stock which is a killer of something...

- Dont care about its industry, this thing goes by its own

- TESLA faces execution risk

- Translation: they dont really master the car building process, quality, etc.

- Again, not a problem as this is a technoloy behemoth and not a car company

- S&P inclusion probably priced in

- I already talked about that in a previous post, some analysts expect the stock to be included in the S&P 500 index and to rise a further 60% or so (dont know how they calculate that; probably they are just guessing)

- So on this point I dont know, this guy is smarter than I am so I pass...

- Market looks toppy

- Maybe but that is not a problem because central banks administer it

- Read: a few more trillions will be thrown at markets if they go down

- So no risk here!

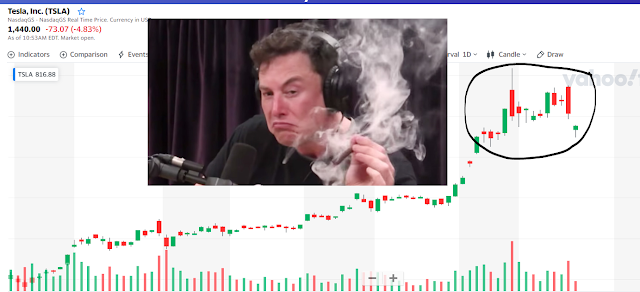

- Musk is showing hubris of his own

- We did cover a bit his attitude towards shorts

- I do understand the guy is arrogant (he adds a few billions to his fortune per day), so he feels high; on top of that, he smokes pot, so we have an explanation here 😎

- Hence no risk on this point...

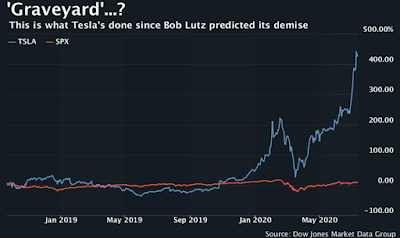

Former GM vice president on TESLA

mercredi 15 juillet 2020

mardi 14 juillet 2020

New Ford Bronco

Is TESLA a car company or a tech behemoth?

“We value [Tesla] like other category killers,” Osha said in a note to clients.

“It is true that TSLA makes cars, while [Apple] and [Nvidia] do not, and it is reasonable to point out that those companies are not perfect comps,” Osha added.

“What is clear is that comparing TSLA to ex-growth auto companies that are losing market share and losing money is not useful. We believe that TSLA is a category killer that is still early in the process of building a dominant position in electric vehicles, and the stock needs to be valued in comparison to other similarly successful companies.”

“We have noticed the comp group for Tesla has changed materially as well,” Jonas added.

“No longer is Tesla being compared to legacy automakers that trade at 1/5th or 1/10th of Tesla's market cap. Increasingly, we’re having discussions with investors who want to talk about Tesla valuation vs. the world’s most successful and highly valued tech firms.

TESLA stock bubble - Its different this time

- TESLA enters S&P 500 Index later this month so that excites everybody. Of course those who are not very excited are stupid (not joining the bubble)

- How Elon is making fun of short sellers by selling pants on TESLA web site

- COVID-19 impact on markets is not an issue because central banks are pumping money into the bubble like crazy

- This is not like the 1999 stock market bubble, only a small correction in S&P 500 towards 2800 points than up we go

- All those money will go into mega-cap stocks (Microsoft, Alphabet, Apple & the likes)

- Coming earnings season will be ugly but that is not a problem either

- Why these names are getting this kind of crazy push? A lot of bullshit coming out of the podcast, but the main argument is "momentum trading". There you have it!

Chuck Prince on Monday dismissed fears that the music was about to stop for the cheap credit-fuelled buy-out boom, saying Citigroup was “still dancing”.

The Citigroup chief executive told the Financial Times that the party would end at some point but there was so much liquidity it would not be disrupted by the turmoil in the US subprime mortgage market.

The most crowded trade ever

Bank of America’s monthly fund manager survey finds 74% say long U.S. tech stocks is the most “crowded trade.” That is the highest reading since the question started being asked in Dec. 2013.

Crowded or not, they are still overweight the tech sector, along with the pharmaceutical sector.

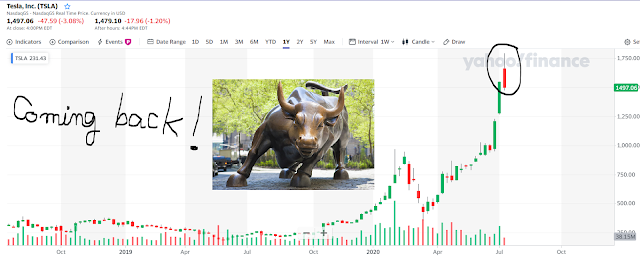

It's coming baby...

Unprofitable TESLA valued more than Toyota & VW combined

TESLA stock & market speculation mania

- We are in a huge bubble similar to Internet in 2000

- At least some of the crazy mania reflects alreay in the price of stocks like TESLA's (and there are many others)

lundi 13 juillet 2020

Why oh my?

Thanks and luv you!

Quicker than Elon...

2000$ per share this week?

samedi 11 juillet 2020

David Einhorn on TESLA - a lot of horse shit

TESLA stock completely detached from reality

Elon's net worth higher than Warren's

What are the chances for TESLA stock to crash?

vendredi 10 juillet 2020

Analysts covering TESLA stock

50% gains in 2 weeks

7x your investment in a year

mardi 7 juillet 2020

lundi 6 juillet 2020

George Soros bubble theory applies to TESLA stock

The loose global monetary policy & TESLA stock

100% away from its 200 DMA

Week starts strong for our baby stock :)

dimanche 5 juillet 2020

Even Elon Musk thinks the TESLA stock is too high...

So who's buying the TESLA stock?

- Retail investors via ETFs of course

- Big speculators who are buying and selling hyped stocks

- In the above blog post a chinese hedge fund is using a strategy which buys today a couple of hot stocks and sells them tomorrow for a profit

- They operate on the chinese stocks (so not related to TESLA stock)

- That seems to work for them as they made a little bit above 100% out of that strategy this year. Wow! That is amazing giving the difficult conditions we have in the economy and the stock market volatility!

- I'm sure there are similar large speculators operating in the US markets

- There are also Las Vegas gamblers like the guy in the above blog post

- Out of job and no income at the moment (probably because of the COVID crisis)

- No understanding of how the products he's buying/selling work

- He's gambling with Apple and Tesla stocks successfull

- Where from is the money coming? Savings? Borrow some at the bank to speculate?

- Are central banks actions for something? I see many pointing the finger in that direction, but to what extent?

- Why all these people behave with no worries at all regarding their money?

- Does it matter where from the money is coming?

Is Nikola a fraud?

Most of you probably did see the report from Hindenburg Research which has detailed evidence about the Nikola company being a complete frau...

-

In case you missed the news, Apple is the 1st company to top 2$ trillions market cap. Its capitalisation basically doubled in less than 2 ye...

-

Its not a "I told you so post", its another reminder how stupid this market goes. Here it is, right in your face: Please note the ...

-

As I wrote here a couple of times, competition on the EV market is coming; this is not a surprise as this market is growing and more and mo...